Multifamily Strategies

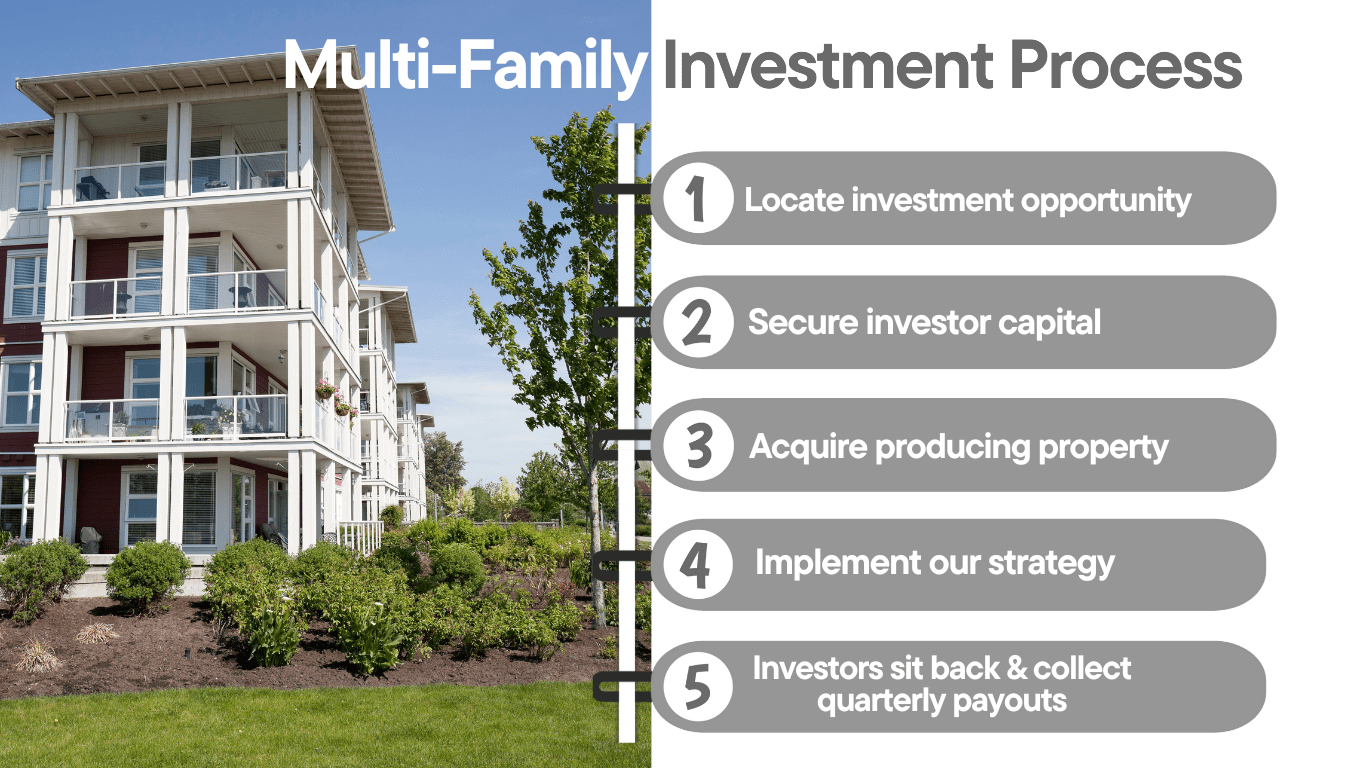

- At Turnkey Capital, our multifamily investment strategy focuses on acquiring B and C class properties in secondary markets. We begin with thorough market research to identify areas with strong job and population growth, analyzing demand trends for these properties. Our dedicated team works collaboratively to ensure efficiency and expertise in every aspect of the investment process. We establish our investment criteria by setting financial goals, such as target returns, and determining specific property characteristics, including size and location. Our sourcing efforts leverage both listings and networking to uncover valuable opportunities, complemented by diligent evaluations of potential properties.

- In structuring our investment approach, we focus on securing favorable financing terms while developing a value-add strategy that identifies renovation and upgrade opportunities, executing a phased plan to enhance property value.

- Effective property management is crucial to our success, enhancing tenant experiences and retention. We continuously monitor performance by tracking financial metrics and adjusting strategies as needed, ensuring that cash flow supports quarterly payouts to our investors.

- As we evaluate exit strategies, we consider options for selling, refinancing, or holding the property, maintaining clear communication with our investors about performance and potential plans. We provide quarterly updates and distribute profits transparently, in alignment with our investment terms. This comprehensive approach embodies Turnkey Capital's commitment to maximizing property value and delivering consistent returns to our investors.

ACQUISITION CRITERIA

Location

We focus on emerging markets with robust indicators of both short- and long-term economic growth, ensuring a sustainable foundation for investment opportunities.

Asset Type

We primarily target Class C- to B+ properties in B- to A neighborhoods, with a preference for buildings constructed no earlier than the 1980s; however, some exceptions may apply based on location and potential.

Property Size

Our investment strategy is centered on multifamily complexes with 20+ units, typically ranging in acquisition value from $3 million to $20 million, allowing for scalable growth and value creation.

Hold Period

Our typical investment horizon spans 5 to 7 years, depending on the specific business plan and the asset’s potential for value appreciation, operational improvement, and market conditions.

Unit Mix

We prefer properties where no more than 25% of the units consist of one-bedroom apartments, ensuring a well-balanced and diverse tenant mix that maximizes both occupancy and rent potential.

Operating History

We seek properties with occupancy rates above 75%, except for those in need of renovation, provided they are in prime locations and present clear value-add opportunities that align with our strategic objectives.

Value Adds

We treat multi-family properties like businesses, with a strong focus on increasing income and overall value. When we acquire an apartment complex, we strategically identify key opportunities to improve cash flow and enhance the property’s worth. Our approach includes:

Upgrading Paints & Exterior: Enhancing the building’s overall appearance to increase curb appeal and attract higher-quality tenants.

Improving Operational Efficiency: Identifying and addressing inefficiencies that impact day-to-day operations, which improves profitability.

Enhancing Common Areas: Updating and modernizing shared spaces such as clubhouses, gyms, and laundry rooms to make them more appealing and functional for residents.

Adding Parks and Recreational Spaces: Developing parks, playgrounds, or other community areas that foster a sense of community and improve the quality of life for tenants.

Increasing Parking Availability: Adding additional parking spaces to accommodate tenant needs and attract new renters.

Improving Safety & Security: Installing security cameras, adding additional lighting, or incorporating security gates to enhance tenant safety and peace of mind.

These improvements collectively drive market value up, increase rental income, and optimize cash flow, offering stronger returns for our investors. Every decision we make is focused on transforming the property into a more valuable, efficient, and profitable asset for long-term success.